Last three days was one of the worst days in India, as India faced one of the worst terror attacks since Independence. Usually, terrorist just plant the bombs in the crowded market place, and just fled away, but this time terrorist action took everybody for surprise. They collaborated and synchronized their tasks and executed them at 9 different places in the city.

But will this really impact the business in India ?

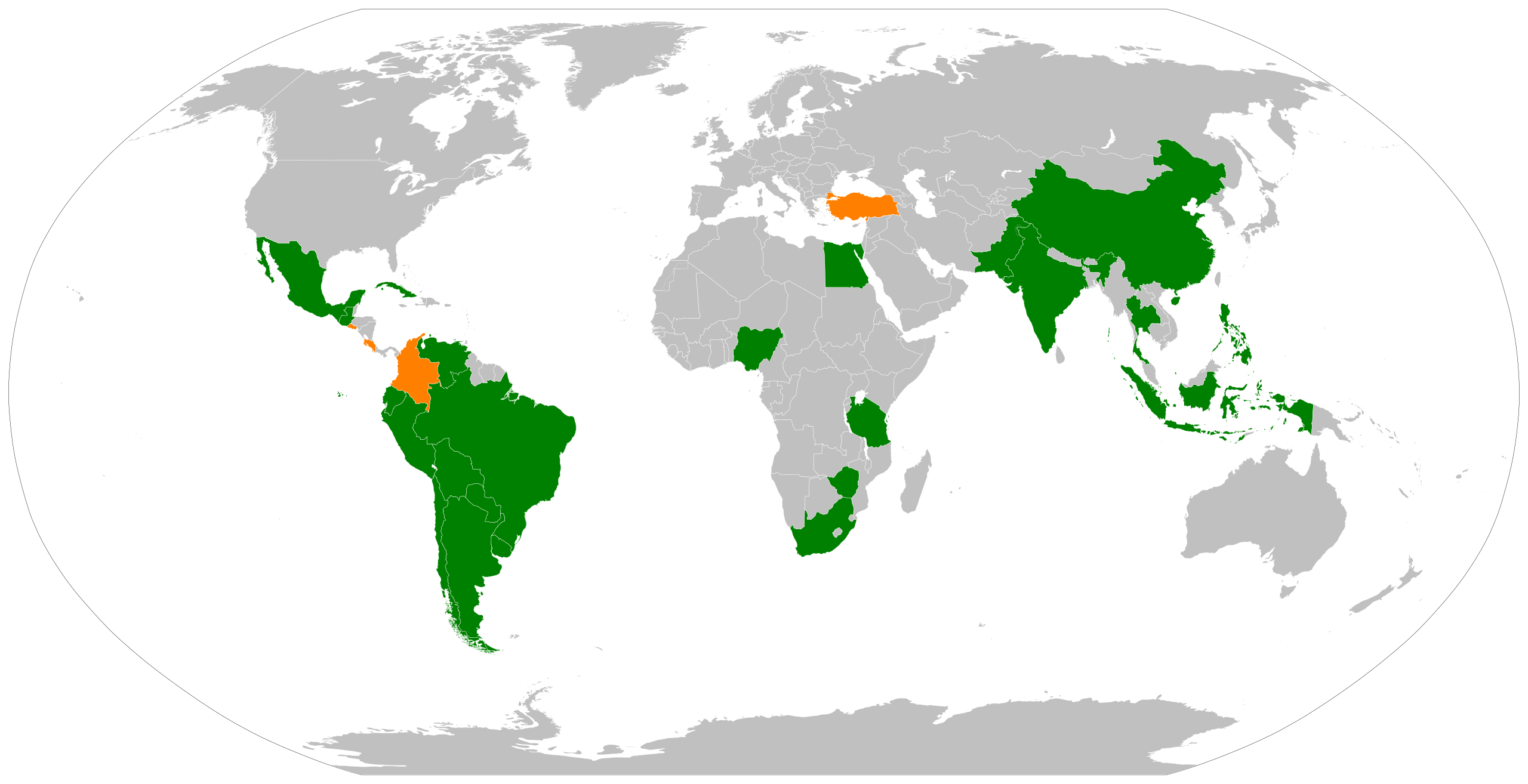

As based on current intelligence report, the main aim of the terrorist attack was to disrupt Indian economy and portrayed as an unsafe country to do business with. But certainly it will certainly harm business sentiments may be for the short time but it certainly will, the most affected sectors will be Airlines, Tourism, Hospitality.Though the affect will be a short term, as terrorism is now a world wide phenomenon, but in this scenario if India decide to face direct with Pakistan, then certainly it will be bad for the entire nation, which certainly will affect the security condition in India, and will certainly show a negative sentiment for doing business in India. So Indian govt. is really need to take both cautionary and strict measures on their next move, as the entire world is watching.

Thanks&Regards,

Mohit

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=feaad0d0-6b80-4788-aff9-3060276e6072)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=b92f44f7-0a31-4cc7-91e4-e1965dc90256)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=d164025e-6fce-4e3c-90fd-e5f517db2f21)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=d532dfb9-8745-4fc4-ab74-78366eb69bae)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=d9e8dd13-1c6c-46cb-9f5f-c01da12f4a99)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=ff97c30e-177f-4dbe-8dca-add9e847f89f)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=74690c6e-8062-4daa-8091-47bb1d1f5f34)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=51a9ad5e-14f4-40a5-bedd-859660851042)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=89aa3fca-b167-4d58-867b-8dc0c8de4720)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=ab8fa80c-e716-4fd5-ad2f-e510f3874543)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=c1c17339-fa81-4629-a30b-c1577997cf48)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=a416a813-6fbe-4ba3-9850-88718cce42ee)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=c9b45cb2-5aec-491f-b700-dd157e679750)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=18e9454c-1a40-4856-ab88-721987b1dc0d)