2008 is the year which brought changes, both at the political and economical front, but it also saw some of the biggest wealth meltdown. Reliance Anil Dhirubhai Ambani Group (RADAG) forayed into number of diverse businesses from Telecom, UMPP, Media erc. saw the stock prces of its flagship companies raised to greater heights during 206-2007 . The launch of RelPower IPO marked a history in Indian bourses, and maded him one of the richest man in the Indian soil just behind his elder brother Mukesh Ambani. But just after the IPO launch the Indian bourses faced a greater meltdown in history, and all companies pionered under ADAG groups suffered great losses, with some its companies lost more than 80% of its peak valuation price, thus making Anil Dhirubahi Ambani pauper by multi million dollars, thus also made him one of the biggest business house failure in recent time.

Thanks&Regards,

Mohit

Monday, December 29, 2008

Sunday, December 28, 2008

2009 : Astrologers Prediction..

Its the end time of the year, the year full of turbulence, be it financial turbulence(in form of Subprime Crisis, Stock market meltdown across the globe ), political turbulence(a black man, taking over the World Top most job, End of peace talk between Indian and Pakistan after 26/11 Mumbai Attacks) . But as the year close by, the astrologers across every circle are carrying out prediction for the next year 2009.Several astrolgers predict that 2009 may bring a sigh of relief to financial markets, and markets may experience little bit of rebound by next year. There total analysis is based on the position of stars, and based on their analysis, these stars will be in favorable position to support market upward movement. While economists worldwide have a totally a contradictory point of view, according to them 2009 may to be a smooth year, the aftermath of 2008 will be feel in 2009, with substantial job losses across all sectors. Lets see whose analysis work ahead in next year.

Thanks&Regards,

Mohit

Thanks&Regards,

Mohit

Saturday, December 20, 2008

Satyam in a jittery !!

Satyam Technology Solutions, India's fourth largest Information technology company was in a state of jittery last week. Apart from feeling heat from global meltdown and loosing some of its biggest clients, it faced an allegation under Corporate governance. Last week, Satyam management decided to take over Maytas Infrastructure and Maytas Properties the companies manged by 54 year old Satyam CEO Mr. B. Ramlinga Raju sons.

The Satyam Maytas deal was valued arround 1.6Bn$, and investors doubt that due to economic gloom Satyam wants to shift its interest from Information Technology to infrastructre business.

The announcement of the deal results in the 55% drop in the value of the ADR in NYSE in US. Within an hour Satyam Investors lost about 2Bn$ at NY bourses, even at BSE Satyam shared suffered a huge hit.

After govt. ordered an investigation in Satyam decision, the Satyam mangement retracted their decsion and cancelled their decision for the bid. At the same time in order to improve the investor sentiments, Satyam CEO decided to go for a buyback or a higher dividend.

This decision certainly hurt investors sentiments, not only toward the Satyam company, but towards the entire Indian IT sector.

So the real question is Will other IT companies will use their cash reserve in doing acquistion in their own sphere, or will their diversify in different sectors to improve their revenue options ?

Thanks&Regards,

Mohit

Thursday, December 18, 2008

Oil : 200 $ to 25 $

In this financial meltdown one commodities which is greatly hit is the Oil. During mid year, analyst involved in Oil and other commodity research pointed out that Oil will reach 200$ mark by ear end. But as the year approaches to an end, scenario is totally changed. Now the same commodity is trading below 50 $ mark and some analyst are predicting the it may fall in the range of 25-30 $ mark.

But the question is why there is a pendulum shift in the Oil prices? Is it the speculators who brought the Oil prices at that level ? Or is the speculators now who are bringing the oil level in submissive level. So certainly seems that economic parameters of demand and supply did not fit in determining the price of the oil, rather it was traders who won the race. This may be applicable for other commodities also, but certainly it fit well for Oil.

Lets see at what level the Oil will go in the coming week.

Thanks&Regards,

Mohit

Tuesday, December 16, 2008

Madoff Havoc on Wall Street..

Bernard Madoff, the 70 year Wall Street Veteran will be known as the one of the biggest fraudster in the years to come. The guy which was one of the renowned figure in the US banking Industry had created a mess and hurt the reputation of US financial firms which will take years to rectify it. According to market analyst, the investors who had invested into Madoff's so called Ponzi schemes may be ripped up of more than 5obn$, thus making this as one of the biggest financial fraud of its time.

Some of the biggest names which burnt their hands in this fraud are, HSBC , BNP Paribas, Royal Bank of Scotland. Even the Banco Santander, the largest bank in the euro zone, lost a fare amount of money in this fraud.

In this difficult financial year, which saw some of the greatest banking failure, this is the last thing which investors expected.

Thanks&Regards,

Mohit Kumar

Monday, December 15, 2008

No respite for the ailing market..

Its often said, if bad thing started.. it will not be ended easily. This is something what is happening with the global markets worldwide. Even though every govt. are taking sufficient measures, from declaring multi billion dollar packages, by opening special lending windows for banks, by reducing cash reserve ratio and statutory liquidity ratio, in order to increase liquidity in the market, and relieve global economy from global recession cover.

But somehow it seems that these measures are short lived, and when the markets tries to recover, the next big fraud or disaster comes into picture which subdued the effects of financial relieve packages.

Latest fraud which added fuel to fire is the 50bn$ fraud carried out by Bernie Madoff, a 78 year old Wall Street Veteran.

It now seems that market respite will surely a distant dream.

Thanks&Regards,

Mohit

But somehow it seems that these measures are short lived, and when the markets tries to recover, the next big fraud or disaster comes into picture which subdued the effects of financial relieve packages.

Latest fraud which added fuel to fire is the 50bn$ fraud carried out by Bernie Madoff, a 78 year old Wall Street Veteran.

It now seems that market respite will surely a distant dream.

Thanks&Regards,

Mohit

Tuesday, December 9, 2008

NRI groom faces the heat of a Market Gloom....

Recent market recession which caused the meltdown of some of the major sectors from Auto, Banking, IT, but this recession also caused meltdown of demand of NRI groom.

In Indian marriage Industry, the so called Non-Resident Indian, abbreviated as NRI, are the hot pancakes always in demand. But things are not more the same, with regular job cut in the developed market and with no sign of early respite from recession, Indian bride would certainly like to look out for their soul mate at their soil itself.

Though marriage analyst says that this may be the temporary face and NRI grooms will be again in the limelight. But till that time comes this market gloom will certainly deprived NRI groom in finding the right bride. :-)

Thanks&Regards,

Mohit

Wednesday, December 3, 2008

Week After Mumbai Terror Attack

26/11 , Mumbai will never forgot this dates for a very long time. The day when terrorist just barged into into Indian Financial capital and left Indian Cosmopolitan City standstill for more than 60 hours.

During the week Indian govt. tried to appease Indian Citizens, which can be seen from the early exodus of inept Home Minister, Shivraj Patil. Constant allegation against Pakistan for promoting terrorism, shown respect to officers who were killed during the mission. Indian defense minister called some highlevel defense meeting and asked for better coordination among the Country defense forces and intelligence agencies. Even the terror strucked Mumbai Citizens paid homage to all those dead and carried out peaceful rallies near the Gateway.

But the question is are they enough? Or even if they are enough, will it last longer ? Will India retaliate more aggressively this time? How will Country put its strategies against terrorism?

The list of question with What, How and When is endless.....

Now there are no question of Wait and See but its now the time for some sporadic actions.

Thanks&Regards,

Mohit

Tuesday, December 2, 2008

US big 3 meet again

Last month, 3 US auto giant GM, Ford and Chrysler approached Congress begging for 25Bn$ bailout package for their package. But somehow Congress were not pleased by the request of 3 auto makers, but they were shown the door and asked to come again, but with some concrete plan. Plan containing Company's future vision, company strategies to curb revenue.

Today, 3 US makers come again to meet US congress with their plans. The plan includes salary cut of top executives, sale of corporate jets, while at the same time GM also proposed to sell off its two brands- Pontiac and Saturn.

But at the same time, the auto makers also raised their request for bailout package. GM demanded somewhere around 18Bn$ while Ford demanded somewhere around 9Bn$.

Though in order to maintain desirable employment level in the country, it seems that Congress may sanction the bailout amount to ailing US auto firms. But before they sanction the money they should ask these auto giants for somewhat more concrete plans, and also raise the question how these firms will return the tax payers money, which they are demanding for. Until and unless, these questions are answered Congress should hold their decision of bailing out these firms.

Thanks&Regards,

Mohit

Saturday, November 29, 2008

Impact on business after Mumbai Terrorist attack

Last three days was one of the worst days in India, as India faced one of the worst terror attacks since Independence. Usually, terrorist just plant the bombs in the crowded market place, and just fled away, but this time terrorist action took everybody for surprise. They collaborated and synchronized their tasks and executed them at 9 different places in the city.

But will this really impact the business in India ?

As based on current intelligence report, the main aim of the terrorist attack was to disrupt Indian economy and portrayed as an unsafe country to do business with. But certainly it will certainly harm business sentiments may be for the short time but it certainly will, the most affected sectors will be Airlines, Tourism, Hospitality.Though the affect will be a short term, as terrorism is now a world wide phenomenon, but in this scenario if India decide to face direct with Pakistan, then certainly it will be bad for the entire nation, which certainly will affect the security condition in India, and will certainly show a negative sentiment for doing business in India. So Indian govt. is really need to take both cautionary and strict measures on their next move, as the entire world is watching.

Thanks&Regards,

Mohit

Monday, November 24, 2008

Bailout package sanctioned for Citigroup

Last weekend was really dramatic for Citigroup, from announcement of 52,000 job cuts, with high probability of filing for bankruptcy, with chances of acquisition or mergers with other banks on the wall street, with Citigroup shares trading at lowest levels in decades. But somehow, Citigroup felt a sigh of relief, when US fed sanctioned a 20bn $ bailout package, and support to underwrite Citi's multibillion dollar toxic assets. The news of bailout package resulted in surge of Citi's stock, with stock trading at 5.87$ up more than 50 % above the previous closing price.

But the question is Will this fund will be sufficient for Citigroup to survive? Besides, other than question of survival, the bigger question is How these funds will be utilised? I think Mr. Pandit has to revisit on the bank policies, and look out for alternate ways to reduce banks expenditure.

Thanks&Regards,

Mohit Kumar

But the question is Will this fund will be sufficient for Citigroup to survive? Besides, other than question of survival, the bigger question is How these funds will be utilised? I think Mr. Pandit has to revisit on the bank policies, and look out for alternate ways to reduce banks expenditure.

Thanks&Regards,

Mohit Kumar

Sunday, November 23, 2008

Tough Time for Mr. Pandit, Chief Honcho Citigroup

In this year we already saw, some of the major fallout of US financial institutions. The year started with Bear Stearn, and by ht mid of year, it already engulfed some of the oldest financial institutions in US, like Lehman Brothers and brokerage firm Meirrill Lynch. But it seems that fallout year is not yet over, and it may be possible that the next bank in the radar can be Mr. Vikram Pandit, run Citigroup.

On friday, Citi stocks on NYSE were trading below 4 $, making its market capitalization somewhere around 20bn$. Though analyst says that it Citigroup financial status is more sound as compare to other failed financial institutions, but somehow, the Citi's current share price doesnot reflect its financial prowess. Overexposure to subprime loans both in the in Mortgage and Credit Cards Lob, really hurt the bank balance sheets.

CEO of Citigroup, Vikram Pandit, and other officials are meeting US fed officials, in order to rescue Citigroup, before it will be difficult for them to prevent US economy for the Worst Financial Crisis. I hope Mr. Pandit will certainly find a solution, so as to make Wall Street cherish on coming Thanks' Giving.

Thanks&Regards,

Mohit Kumar

Thursday, November 20, 2008

US Auto majors beg for their survival

Detroit, the auto hub of the World, and headquarters of major US auto companies like GM and Ford. But nowever days, Detroit streets have a deserted look, as 3 US Auto majors GM, Ford and Chrysler file for their bankruptcy and requested a 25bn$ bailout pie from Fed approved 700Bn$ economy bailout plan.

Its a very old saying in India, "Behti Ganga mein haath dhona" (Wash your hands in the running waters). This is what these auto companies are doing, they are thinking that as US fed is bailing out banks from the financial crisis , they will certainly bailout them. But the real question at the first time is, Why these auto companies are in such a crisis? These are not the companies who lended subprime loans, but these are the companies who are settled in among the auto loving consumers.

So why they are in such a mess? and why now are they begging for survival?

The answer lies in complete mismangement by the senior management of these firms which leads lavish spending by the senior management and lack of timeley decision. ,and second most important thing is lack of innovation by these auto makers. When world auto markets are demanding more fuel efficient and environmental friendly cars, these auto makers are still developing less efficient cars.

So before they ask fed for the bailout plan, they have to provide a viable plan, how will they are going to use the money, what will be their strategy to increase revenues, how will they leverage in house technology or export new technology from outside world? How will they deal with their competitors? What will be their strategy for the emerging economies? How will they decrease their expenditure? How will they increase their utilization rate?

They have to answer many such What? How? and Why? questions before they really ask US fed for the aid.

Thanks&Regards,

Mohit

Sunday, November 16, 2008

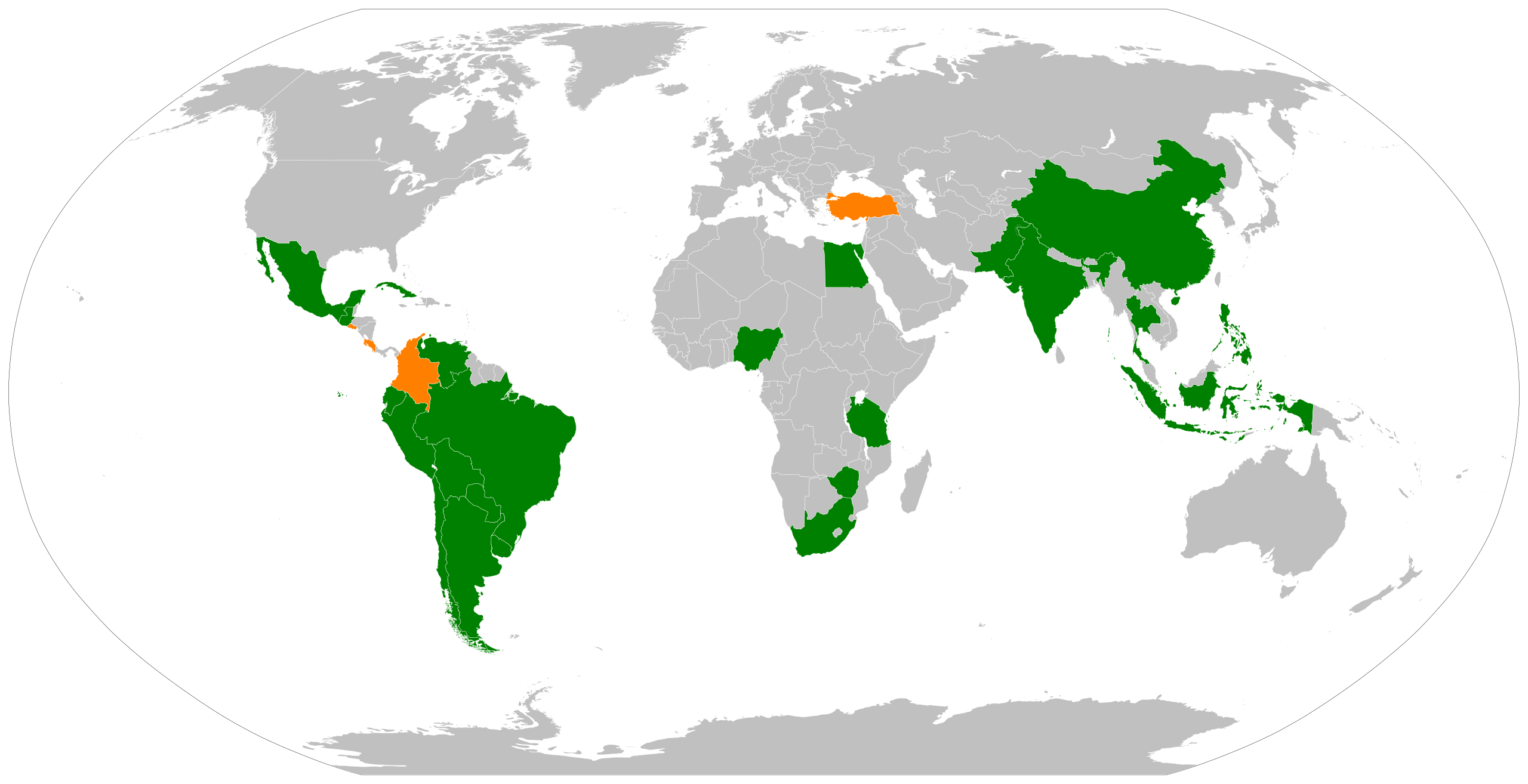

G20 countries collaborate for Global Financial rescue.

With World Economy shattering and moving towards recession, it had faced in decades. To rescue the World economy from Global slowdown, leaders from the top 20 countries met in Washington on

Saturday to tackle collaboratively on this problem.

The agenda of the meet is to look out for the causes of the Global crisis and the solutions to fix these problems, and a the solutions or strategies to prevent such kind of problems in future.

The G20 nations discussed about the strategies on utilization of stimulus packages, and talked of economic stimulative measures like decreasing interest rates and bailing out banks and financial institutions.

They added that they have to work collaboratively to boost developing economies, which saw the major meltdown in their crisis. They added that if required, the developing economies, fund channeling may be routed through International Monetary Fund(IMF).

Besides, discussing on financial rescue measures, they also discussed on more regulation for financial and capital markets and to improve oversight of Credit rating agencies and to make investor fully aware of the risk involved in complex financial instruments before financial system posses another level of instability.

The international financial mess is already been created and instead of financial rescue plans from key G7 countries, it really calls for a collaborative effort from all the countries, to clean up this mess, before it pose a major threat to World Security.

G20 Countries :

- Argentina

- Australia

- Brazil

- Britain

- Canada

- China

- European Union

- France

- Germany

- India

- Indonesia

- Italy

- Japan

- Mexico

- Russia

- South Africa

- Saudi Arabia

- South Korea

- Turkey

- United States

Thanks&Regards,

Mohit Kumar

Wednesday, November 12, 2008

Biofuels viabilty as a future fuel?

Biofuels are often considered alternative to both petrol and diesel, terms of price, environment and low production cost. Though somehow now the price of crude oil is moving around 55-60$ (NYMEX) per barrel, which is considerably down when compare to 147$ six months ago. With fear of global recession the price of lowered to considerable low level, but as when global economy again take an upward, analyst crude price prediction of 200$ will then not be a distant dream, at that time the more price sensitive Biofuels will come into picture.

Besides, apart from alternative to fossil fuels, Biofuels also are economical on may fronts, environment, foreign exchange, self reliance, energy sufficient and security.

Thanks&Regards,

Mohit Kumar

Tuesday, November 11, 2008

Amex changed its profile

Amidst the financial crisis clouds, American Express, popularly known as Amex, decided to change its line of business from Credit cards, Business services and Travel Services to more traditional commercial banking operations. Thus, after Goldman Sachs and Morgan Stanley, Amex becomes the third bank on Wall Street to change its banking status.

The move will give Amex to increase their deposits- a more stable form of funding, besides it will easily get the more safer access of fed funding and will be under constant scanner of Fed.

Amex (AXP) stocks fell to around 22$ during the Mid-Day trading.

Thanks&Regards,

Mohit Kumar

Monday, November 10, 2008

China billion dollar economy stimulus package

It's often said, when going gets tough, the tough gets going. But in this economy crisis, even the toughest of all economies failed to survive. China announces a 586 bn$ economy package, which they will spend in coming years in building country's infrastructure and also smooth line lending process in the country financial system.

Though the news of economy stimulus helped stocks surge in Asian economies, while the same news caused stocks plunge in the US markets, with US stocks dropped as a worsening outlook from companies like Glodman Sachs and Google Inc.

Lets wait and see how this economic stimulus package will help revival of the Chinese economy.

Thanks&Regards,

Mohit Kumar

Sunday, November 9, 2008

Feeling the financial Pain by BRIC

BRIC, acronym stands for Brazil, Russia , India and China basically one of the highest growing economy in the recent times, and according to some of the industry experts in coming years, may become biggest economies in the World.

But recent financial crisis in US and Europe recently affected this BRIC economies, while stock markets in this region have almost lost their 50% of their valuations in recent times. Liquidity crisis, credit crunch, inflation , unemployment, layoffs, bad consumer sentiments are looming all over this BRIC economies, thus forming a bad time for these economies.

But this financial crisis, really helped these BRIC industries to remove themselves from the dependencies of developed economies, and instead of more export centric, try to build their own domestic consumption, diversify their business, develop an inhouse R&D facilities.

Though it will be difficult to keep themselves aloof in this flat world, but it will certainly help them to move smoothly in this financial crisis.

Thanks&Regards,

Mohit Kumar

Saturday, November 8, 2008

Obama Solution to Economy Crisis : Greener Energy

After Mr. Obama defeated Mr. Mcain and marked his place as the 44th US President. With the winning of the US presidential race, the next big task which revolves around the new president is revival of the economy and creation of new jobs. While US employment rate is at 14 year low, at 6.5%, the creation of new jobs in this difficult times is really a difficult times.

To all the economy crisis, Obama solution is patronage of Greener Energy soltuions, which included building of Wind Turbines, fitting of solar cells units, leveraging of technolgy in building environmental friendly coal.With inclusion of such a new initiatives he pointed that it will create around 5 million jobs.But the question is where will the funding of such plans will come from? Will the govt. once again put additional tax on the tax payers, and raised the required fund? But raising tax again means, making Obama unfavorable among US voters. So this will be the last thing the new preisdent and his transition team will think of. But currently Obama is pursuing to implement its Cap and trade plan, under which Govt. will auction permit to companies, and with every successive year it will reduce permits, thus reducing the Greenhouse gas emission in the atmosphere. The money generated with this auction will be used for more job creation.

Though Obama greener plans currently sounds more oppurtnistic and in favor of the economy, but lets see what will happen next, when he will put this plans into execution.

Thanks&Regards,

Mohit

Thursday, November 6, 2008

Tough task ahead for Mr. Obama

Ex-Senator of Illinois state, and now the 44th president of United State, the African American Barack Obama will join Us presidential office 10 weeks from now. But it will certainly will not be an easy power transition from Mr. Bush to Mr. Obama.

Some of the key task which the new president have to take care, after he take over the office from Mr. Bush.

1. Economy Revival : Implement new strategies to revive the economy.

2. Maintain peace in the Gulf region .

3. Form strategies and policies to improve situation is Iraq and Afghanistan.

4. Try to form cordial relations with Iran and North Korea, and look out ways to check on their Nuclear ambition.

5. Play a big daddy role in improving bilateral ties between India and Pakistan.

6. Reduce tensions with Russia regarding deployment of Anti-Missile system in Europe.

7. Reduce unemployment figures.

8. Improve health condition of Americans.

9. Work on world peace.

10. Take measures to prevent Global Recession.

Thanks&Regards,

Mohit Kumar

Tuesday, November 4, 2008

US stock surges on Election Day

As US 2008 presidential candidate is on the brink, while on one side US voters putting their votes in the ballot boxes, on the other side, US investors came back to bourses, with US stocks surges by more than 300 point on the election day. The Energy and the banking shares were the front end shares in today's rally. The S&P 500 added app. 40 points and closes above 1000 points, while Dow Jones Industrial Index settled above 9600 points. Some Wall Street analysts also pointed out that the Armageddon of Crisis is over, with market may see some better days ahead. But from my opinion, the state of crisis is still not over, this may be short bull run in this highly volatile scenario, and with change of leadership in the US politics may helped bull to come out from the den, but still its a long way to go before market will be in a position to move on smoothly.

Thanks&Regards,

Mohit

Monday, November 3, 2008

Upheaval task for new US president.

With every passing day, the US presidential race become more exciting, sometimes election polls favored Obama, while next time election poll pendulum moved towards Mcain. But whoever win the US 08 presidential election, it will be certainly a sleepless night for them. As first and foremost task for the new president will be US economy revival from the current Financial crisis, secondly he have to bring back investors back to Capital Market, and make world believe in the sanctity of the US financial system. Besides, they have to make sure that 700bn$ bailout package sanctioned by Bush administration should be spent in a proper way, and try to return money to already oppressed US taxpayers.

Lets wait and see how new US president will formulate his policies.

Thanks&Regards,

Mohit

Lets wait and see how new US president will formulate his policies.

Thanks&Regards,

Mohit

Sunday, November 2, 2008

More Job Cuts in this Financial Downturn

With financial crisis and the fear of global recession engulf everybody in the world. With financial crisis there are some sectors which are more vulnerable to job cuts.

Some industirs which will suffer the most :

1. Housing : The sector which was the root cause the worst financial crisis after 1929, Great Depression, is now also the most vulnerable in terms of job lost, and will witness more layoff in days to come. Jobs which are more vulnerable in housing sectors are Mortgage brokers, homemakers, mortgage lenders, commercial real estate and real state agencies.

2. Financial : After housing , financial people found their jobs more un-secure in this crisis. With stock market tumbling world over, and no body in the financial markets are lending money to each other, which leads to a bad business for banks and the financial sectors and thus may result in more job cuts.

3. Retail : Even before the financial crisis, retailers were railing with the rising oil prices and rising inflation, which kept the customers out of shopping counters. But after the financial crisis, the thing seems to even worsen for the retailers, with more layoff looking over different sectors, and people want to cut on their spending, in order to save money for the worst time ahead. As more and more customers, spending less, which means hard time for retailers.

4. Autos : Just like retail, first it was oil and now its liquidity crunch which is falling on the revenue of the auto majors in the industry. While sales at big three automakers had already taken a hit this year, and prediction is not that good for the last quarter, which may leads to more job cut in this sector also.

5. Travel : Airline sectors have already started layoff before the crisis, and after the crisis, with customer liked to save their money and corporates liked to cut costs by leveraging technology which kept their employees from traveling. So as less people travel this season, which means more layoff in this industry.

Thanks&Regards,

Mohit

Wednesday, October 29, 2008

Fed cut rates.

In order to create liquidity pool in the economy,and to curb credit crunch in the economy, today fed announces another rate cut by 0.5 percent, thus now the offering rate is 1.0%. The rate cut clearly shows the gloomy outlook of the economy, with federal reserve giving out warning sirens and stating that, economic revival make take some time.

The current rate cut matches with the lowest rate cut ever carried out by federal reserve, the last time federal decreased the rate to 1% was in 2003-2004, which clearly triggered the subprime lending and resulted in the one of the largest financial turmoil in decades.

Thanks&Regards,

Mohit

Tuesday, October 28, 2008

Sensex ended up on Mahurat Trading

In the grim market situations, when every stocks on the exchange are battering fo their suvival, with some of the stocks are trading way below their offering prices. But some how this Diwali, which also announces the Samvat 2065, bought a sigh of relief to investors. With on Mahurat trading, India BSE sensex, closes with a 5 percent gain, and somehow crosses the 9000 mark.

Thanks&Regards,

Mohit

Monday, October 27, 2008

Recession in US markets

With the markets throughout the world are moving downwards, and chief of all states are coming together and somehow with cold words stating that their economy is in recession. I was just googling around and found the list of some of the major recessions which had takne place in the recent past.

With the markets throughout the world are moving downwards, and chief of all states are coming together and somehow with cold words stating that their economy is in recession. I was just googling around and found the list of some of the major recessions which had takne place in the recent past.Recession definition : (Source Bnet)

a stage of the business cycle in which the economic activty is in slow decline. Recessions usually follows a boom, and precedes a depression.It is characteriszed by rising unemployment and falling levels of output and investment.

Here find the list :

1. Post World War Recession [3 Years]

2. 1929 Great Depression [10 Years]

3. Recession of 1953 [1 Year]

4. Recession of 1957 [1 Year]

5. 1973 Oil Crisis [2 Years]

6. Early 1980'2 recession [2 years]

7.Early 1990's recession [1 Year]

8. Early 2000's recession [2 Years]

Thanks&Regards,

Mohit

Sunday, October 26, 2008

Common people expression on Financial market

Markets throughout the world are rallying southwards, the financial turmoil which started with US housing downturn has now starting showing its effects every where in the world. Here find some of the comments from the common people, who are directly affected by this financial crisis.

Expressions like :

1. Sensex is down, its all time low.

2. I have lost 100,00$ in this financial crisis.

3. I think the whole world is in a problem.

4. World economy is tied to US economy, which make even thing harder for the other economy to survive this global turmoil.

5. Besides, the whole world has invested in the US market, they will in the same ride as US is.

6.Stock exchanges are all time low, all major banks in the US are plummeting like anything.

7. How can they lend money, to anybody without any supervision.

8. If subprime mortgage wouldn't happened in US, it would not have happened anywhere else in the world.

9.Next 6-8 months will be tough, will see more downgrades in the unemployment levels etc.

10.Its has to get better,its cannot get worse.

The expression clearly shows hoe badly the crisis are, and how bad it can be if its not rectified in coming months.

Thanks&Regards,

Mohit

Wednesday, October 22, 2008

Who murdered the Financial System?

Today, as I was going through the pages of Indian English Daily Times of India, I came across an article, the heading of the article was "Who murdered the Financial System? The article discussed about the people responsible for the such a financial mayhem.

Here find the synopsis of the article.

According to TOI, everyone from makers to consumers to regulators were responsible , but they narrow down there list to 10 murderers of US financial system.

1. Federal Reserve Board : They were responsible for forming bubble economy, and did not notice it when the bubble was on the verge of a bust.

2. US Politicians : They envisioned a house for every American, regardless of their income, and formed unregulated govt. agencies Freddie Mac and Fannie Mae, which disbursed loans like anything.

3. Fannie Mae and Freddie Mac : They resisted regulation, and spent over 2million$ lobbying legislators against any tightening of rules.

4. Financial Innovators : Financial Engineers working at the Wall street, created new structured products backed by subprime mortgages and sold to investors.

5. Regulators : Everybody in the financial markets were sleeping and no body cared to check the worthiness of the CDO's.

6. Banks and mortgage lenders : Instead of keeping the mortgages at their own books, lenders packaged it into security and sold it to other financial players and increase their liquidity, which results in more lending and vice versa. Besides, banks were busy on giving loans to people without checking their financial capabilities, which added fuel to fire in the financial crisis.

7. Investment Banks : Once these financial institutions provided services like underwriting, M&A, IPOs etc. But recently they started borrowing money to trade into their accounts.

8. Rating Agency : They offered ratings which were inappropriate for some of the financial instruments available in the market.

9. Basel Rule for Banks :

10. US consumers : Some times ago, US households savings were 6% of the disposable income, but now its either zero or negative. They have gone on a borrowing spree to spend far more than they earn.

10. Asian and Opec Counties : They undervalued their currency to simulate exports to US markets. They accumulated billions of forex US dollar reserves and put them into dollar securites, thus depressing the US interest rates and increased borrowing.

source, TOI

Thanks&Regards,

Mohit

Saturday, October 18, 2008

Wealth Erosion of India's Top 10 business houses

Recently financial crisis which caused stock market free fall in all the stock markets throughout the World. Indian Stock market is considered to be worst Asian performer in this financial mayhem. On friday 17-10-2008, India's top business houses lost about whopping 139Bn$ of market capitalization, when compared to their market capitalization on January 2008.

Worst Performers :

1 .Anil Ambani : Loss around 32Bn$, erosion of his wealth by whopping 70%.

2. Mukesh Ambani : Current net worth 22bn$, lost about 54% wealth in this financial mayhem.

3. Sunil Bharti Mittal : His stake in Airtel is valued at about 12bn$, and he lost about 30%.

4. K P Singh : DLF promoter saw is state is just now 1/4 of what it was in the starting of the year. His current stake is roughly around 9bn$.

This figures really showed how bear is looming over stock markets in India.

Thanks&Regards,

Mohit

Subscribe to:

Posts (Atom)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=8f880012-7645-40b4-a131-6fa73d961565)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=e2684e6b-ad34-4eb8-91ae-ef75dd040673)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=09b1231e-5f9d-41fc-83ef-75c28fdc48d0)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=905ced44-0e05-4933-b57d-6f67f12b6582)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=43c0b1b4-d11b-46b6-a15c-73695c821224)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=7d5eedba-f68b-4f7e-a722-1d69766ffe62)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=33b3a967-579c-4c8b-8518-3b5dac29a3ba)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=2a6c9554-2094-432e-976c-d816bd652cac)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=feaad0d0-6b80-4788-aff9-3060276e6072)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=b92f44f7-0a31-4cc7-91e4-e1965dc90256)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=d164025e-6fce-4e3c-90fd-e5f517db2f21)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=d532dfb9-8745-4fc4-ab74-78366eb69bae)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=d9e8dd13-1c6c-46cb-9f5f-c01da12f4a99)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=ff97c30e-177f-4dbe-8dca-add9e847f89f)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=74690c6e-8062-4daa-8091-47bb1d1f5f34)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=51a9ad5e-14f4-40a5-bedd-859660851042)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=89aa3fca-b167-4d58-867b-8dc0c8de4720)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=ab8fa80c-e716-4fd5-ad2f-e510f3874543)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=c1c17339-fa81-4629-a30b-c1577997cf48)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=a416a813-6fbe-4ba3-9850-88718cce42ee)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=c9b45cb2-5aec-491f-b700-dd157e679750)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=18e9454c-1a40-4856-ab88-721987b1dc0d)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=12a78e15-73ee-44f3-9d64-5844a5a10dbc)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=2b19bc7f-03f9-4559-a51e-b76c90be9970)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=0398788f-8d55-4e2d-8126-a596338e200b)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=a850ffab-cb9f-438f-8c34-f3623cd56cb6)